INTERACTIVE FEATURES: When viewing this article on an electronic device, note that web addresses are live links. Just click the link to visit that web page.

Click for instructions for moving the PDF into Kindle, Nook, Apple iBooks, and Apple Library.

How This Can Impact Contracting with Payers?

CMS’ letter to state Medicaid directors invites them to test new, integrated care models for individuals dually eligible for Medicare and Medicaid.

“States could consider approaches broadly applicable to all dually eligible individuals or focus on certain segments of the population, such as people using long-term services and supports, younger people with disabilities, and/or people living in rural areas,” the letter said.

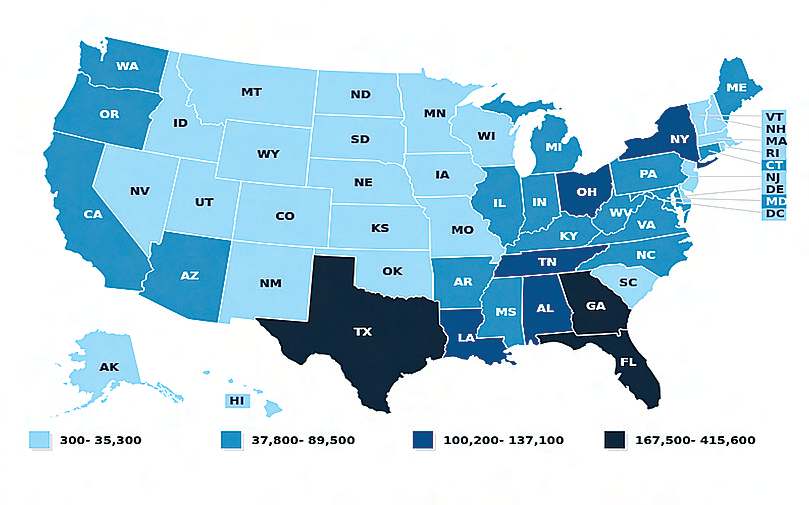

Number of Dual Eligible Beneficiaries: Partial Dual Eligibles, FY 2013

CMS’ innovation center (CMMI) is about to roll out a new model allowing insurance plans to take on financial risk for patients enrolled in both Medicare and Medicaid.

The pilot will allow managed care organizations that assume risk for a patient enrolled in Medicaid to also assume risk for that same patient in fee-for-service Medicare.

There are 12 million dual eligible beneficiaries, according to CMS. Many of them have complex medical issues, including multiple chronic conditions. Often, they also have socioeconomic risk factors that can lead to poor health outcomes.

Dually eligible people makeup just 20% of Medicare and 15% of Medicaid but account for 34% and 33% of program costs respectively, according to CMS.

The new value-based CMMI model could see acute industry interest should it prove successful in lowering costs. Spending in Medicaid & Medicare snowballed amid the COVID-19 pandemic.

What Does This Mean to Payers?

Allowing payers to assume risk for a dual-eligible population is an idea CMMI has tested before. The upcoming pilot will be based on CMMI’s direct contracting model, which offers capitated payments for Medicare FFS beneficiaries through partial or full downside risk.

Generally, Medicaid managed care organizations get upfront fixed payments from states, based on expected utilization of covered services, administrative costs, and profit for their patient population. By comparison, Medicare plans are paid retroactively, based on the number of services their beneficiaries use.

Dual eligible beneficiaries are patients enrolled in Medicare and getting full Medicaid benefits or assistance with Medicare premiums or cost-sharing through Medicaid. Medicare usually pays for dual-eligible patients’ services first because Medicaid is always the payer of last resort. However, Medicaid covers some services Medicare doesn’t, like nursing home care, behavioral healthcare, and home-based services.

What’s Ahead?

Another model CMMI plans to roll out in the coming months is around geographic direct contracting. The trial would allow insurers, providers, and other healthcare organizations to assume financial risk for all Medicare lives, or a portion of Medicare lives, in a specific geographic region.

In exchange, they’d get much more flexibility in how to structure their program, including building preferred networks, potentially processing claims and other allowances while ensuring beneficiaries still have access to all providers available in Medicare.

Lisa Remington is widely recognized as one of the foremost futurists in the home care industry, focusing on healthcare trends and disruptive innovation. She serves as the president and publisher of the Remington Report magazine and is also the President of Remington’s Think Tank Strategy Institute. Lisa provides strategic advice and education to over 10,000 organizations, assisting them in developing transformative strategies for growth and their future implications. She closely monitors complex trends and forces of change to develop effective strategic approaches.