INTERACTIVE FEATURES: When viewing this article on an electronic device, note that web addresses are live links. Just click the link to visit that web page.

Click for instructions for moving the PDF into Kindle, Nook, Apple iBooks, and Apple Library.

What New Paradigm Shifts Impact Future Care Delivery Models?

Healthcare providers and consumers have seen a massive acceleration in the use of telehealth.

“Providers and patients are concerned that recent federal and state policies expanding access to telehealth will be rolled back once the emergency period ends.”

– Lisa Remington

President, Remington Report

Publisher, The Remington Report

Telehealth Adoption Key Highlights:

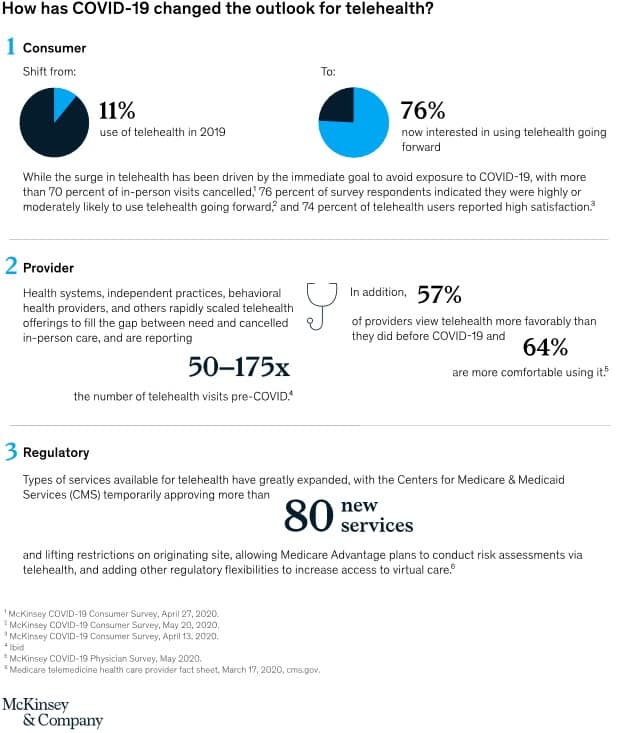

- Consumer adoption has skyrocketed, from 11 percent of U.S. consumers using telehealth in 2019 to 46 percent of consumers now using telehealth to replace canceled healthcare visits.

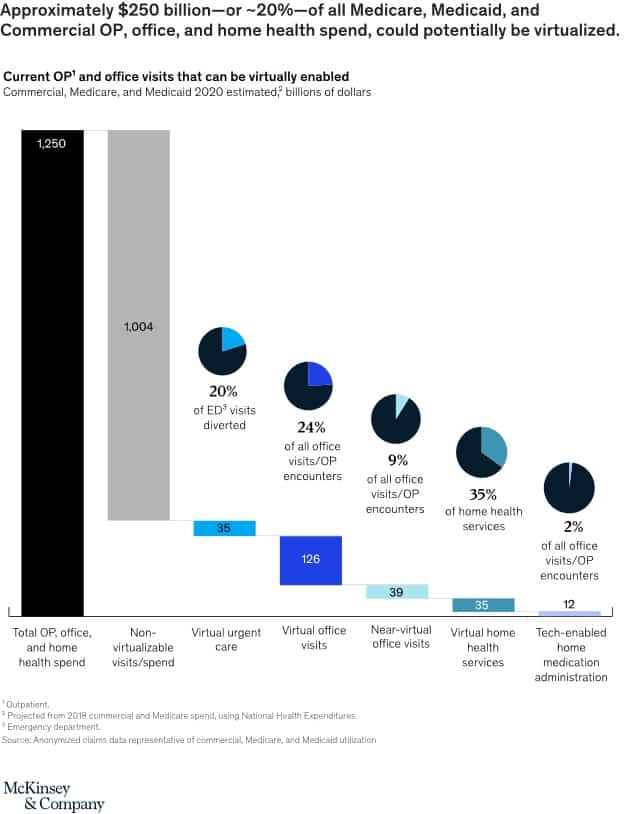

- The acceleration of consumer and provider adoption of telehealth and extension of telehealth beyond virtual urgent care, is up $250 billion of current U.S. healthcare spend and could potentially be virtualized.

- Telehealth is now poised to take a bigger share of the healthcare market to $250 billion, or 20% of all Medicare, Medicaid, and commercial outpatient, office, and home health spend that could be done virtually.

Telehealth Moving Forward

A McKinsey report found that about 76% of consumers say they are highly or moderately likely to use telehealth in the future. Seventy-four percent of people who had used telehealth reported high satisfaction. (See Figure 1)

Changing The Future Care Delivery System

The report looked at anonymized claims data representative of commercial, Medicare, and Medicaid utilization.

McKinsey’s report claims-based analysis of commercial, Medicare, and Medicaid utilization suggests that approximately 20% of all emergency room visits could potentially be avoided via virtual urgent care offerings, 24% of healthcare office visits and outpatient volume could be delivered virtually, and an additional 9% near-virtually.

Many of the dynamics that have helped to expand telehealth adoption are likely to be in place for at least the next 12 to 18 months, as concerns about COVID-19 remain until a vaccine is widely available.

Going forward, telehealth can increase access to necessary care in areas with shortages, such as behavioral health, improve the patient experience, and improve health outcomes.

McKinsey outlined steps industry stakeholders should take to drive the growth of telehealth.

Payers: Health plans should look to optimize provider networks and accelerate value-based contracting to incentivize telehealth. Align incentives for using telehealth, particularly for chronic patients, with the shift to risk-based payment models.

Payers also should build virtual health into new product designs to meet changing consumer preferences, This new design may include virtual-first networks, digital front-door features (for example, e-triage), seamless “plug-and-play” capabilities to offer innovative digital solutions, and benefit coverage for at-home diagnostic kits.

Health systems: Hospitals and health systems should accelerate the development of an overall consumer-integrated “front door.” Consider what the integrated product will initially cover beyond what currently exists and integrate with what may have been put in place in response to COVID-19, for example, e-triage, scheduling, clinic visits, record access.

Providers also should build the capabilities and incentives of the provider workforce to support virtual care, including, workflow design, centralized scheduling, and continuing education. And, health systems need to take steps to measure the value of virtual care by quantifying clinical outcomes, access improvement, and patient/provider satisfaction. Include the potential value from telehealth when contracting with payers for risk models to manage chronic patients, McKinsey said.

“Up to 35% of regular home health attendant services could be virtualized, and 2% of all outpatient volume could be shifted to the home setting, with tech-enabled medication administration.”

Investors and health technology firms: These players also can support the new reality of expanded telehealth services. Technology firms should consider developing scenarios on how virtual health will evolve and when, including how usage evolved post-COVID-19, based on expected consumer preferences, reimbursement, CMS, and other regulations.

Investors also should develop potential options and define investment strategies based on the expected virtual health future. For example, combinations of existing players/platforms, linkages between in-person and virtual care offerings and create sustainable value. Investors and technology companies also can identify the assets and capabilities to implement these options, including specific assets or capabilities to best enable the play, and business models that will deliver attractive returns. (See Figure 2)

The Future Holds Some “Kinks”

Providers and patients are concerned that recent federal and state policies expanding access to telehealth will be rolled back once the emergency period ends.

“I can’t imagine going back,” said Seema Verma, administrator of the Centers for Medicare and Medicaid Services at a STAT virtual event. “People recognize the value of this, so it seems like it would not be a good thing to force our beneficiaries to go back to in-person visits.”

In a letter to the CMS from the Federal Trade Commission (FTC), executives offered several proposals to extend CMS directives issued during COVID-19 to expand telehealth access and coverage.

The letter addresses six issues:

1. Relaxation of distant site guidelines.

CMS has used its waiver authority to allow Medicare coverage for telehealth services provided at any location, including metropolitan locations, health clinics, and the patient’s home. Before COVID-19, CMS sharply restricted telehealth coverage to certain types of healthcare facilities.

“Although the public health emergency necessitated immediate removal of the geographic and originating site requirements, longstanding and broad support for eliminating these requirements existed before the pandemic,” the FTC noted. “These requirements preclude reimbursement for services provided to urban beneficiaries with limited access to in-person care because of mobility, economic, or other barriers, as well as rural populations who may live far from an authorized originating site. The requirements inhibit entry of telehealth providers and limit patients’ access to care and choice of provider. Accordingly, the requirements could limit competition among practitioners, potentially reducing the quality and amount of care and increasing its costs.”

“For these reasons, we strongly support suspending these requirements during the public health emergency, and we urge CMS to consider whether they should be permanently eliminated,” the agency concluded.

2. Expanding the types of services delivered by telehealth.

During the pandemic, CMS has added more than 80 healthcare services to its coverage guidelines, including ED visits, care delivered in a skilled nursing facility and health centers, ICU services, and some home-based care.

“Without this expansion of reimbursable telehealth services, it could be difficult or impossible to provide many of the newly authorized services safely,” the FTC points out. “By allowing practitioners to provide services remotely, especially in areas of need that are far away, the change likely increases beneficiaries’ access to needed care during the public health crisis. The change also could enhance the quality of services provided, increase competition, and reduce costs.”

“The expansion of reimbursable telehealth services during this public health emergency should highlight the benefits and drawbacks of using telehealth to provide different types of services,” the letter concludes. “As a result, CMS will be in a better position to decide whether to continue some or all of the added services after this emergency ends.”

3. Access to therapy services by more telehealth providers.

CMS has opened the door to coverage of therapy services during the pandemic and given certain providers, including physical and occupational therapists, audiologists, and speech-language pathologists, the green light to provide those services. The agency had to amend its initial action after it was pointed out that CMS first expanded coverage for those services but did not include therapy practitioners in the list of healthcare providers allowed to deliver those services.

“Based on its experience with reimbursing therapy practitioners for telehealth services during the current public health crisis, CMS should consider permanently adding these practitioners to the list of authorized telehealth providers,” the FTC advises. “There is longstanding support for Medicare reimbursement of therapy practitioners and other practitioners not ordinarily eligible for reimbursement of telehealth services. Making them authorized telehealth providers on a permanent basis could enhance the availability of therapists, access to care, choice of provider, competition, and quality, and also could reduce costs. Such improvements may especially benefit rural and underserved communities, as well as patients for whom travel is difficult.”

4. Coverage for new modalities.

CMS has also expanded Medicare coverage to a broad range of modalities during the emergency, including audio-only telephone. Telehealth advocates have long argued that underserved population often lack access to the technology and/or the broadband connectivity needed to access telehealth.

“Allowing reimbursement for care provided by audio-only telephone as a telehealth service potentially increases access to safe and effective care and enhances competition among providers, especially in rural and underserved areas where access to audio/video devices and broadband service may be limited,” the FTC letter states. “We suggest that CMS consider whether such benefits support continuing telehealth reimbursement of audio-only telephone services after this crisis, or whether its experience with expanded telehealth reimbursement of these services reveals legitimate health and safety concerns that could justify discontinuing or narrowing such reimbursement after this public health emergency ends.”

5. Coverage for non-telehealth communication technology-based services (CTBS).

During the current emergency, CMS has expanded the coverage umbrella to help providers connect with new patients through virtual check-ins, remote patient monitoring platforms, and telephone services without the need to first conduct an in-person examination.

The guidelines were particularly challenging for direct-to-consumer telehealth platforms before COVID-19, in that providers had to first schedule an in-person exam to meet requirements of an established doctor-patient relationship before moving to a connected health platform. With the pandemic severely curtailing in-person visits, CMS relaxed those rules.

“FTC advocacy has favored flexible provisions that allow the licensed practitioner in the best position to weigh access, health, and safety considerations to decide whether to use telehealth,” the FTC says. “Such policies, which allow the patient-practitioner relationship to be established by telehealth and typically hold the practitioner to an in-person standard of care, are supported by several physicians’ organizations.”

“We suggest that after the public health emergency ends, CMS consider allowing licensed practitioners to decide whether to provide at least some CTBS services to new as well as established patients,” the agency concludes. “This approach would better promote competition and access to safe and affordable care.”

6. Supervision guidelines under Medicare’s “Incident To” billing rules, when delivered via telemedicine.

Finally, CMS relaxed its direct supervision guidelines for the duration of the emergency to allow Medicare coverage for services provided by non-physician practitioners, such as physician assistants and advanced practice registered nurse practitioners.

In its letter, the FTC recommends that CMS amend its rules to eliminate direct supervision of non-physician practitioners in non-institutional settings, and give that authority to the states.

“Eliminating Medicare’s direct supervision requirement could improve access to health care professionals and services, especially in health professional shortage and underserved areas,” the letter states. “Accordingly, we urge CMS to consider whether there are well-founded health and safety justifications for retaining the direct supervision requirement.”

“CMS has added more than 80 healthcare services to its coverage guidelines, including ED visits, care delivered in a skilled nursing facility and health centers, ICU services, and some home-based care.”

“More generally, we recommend that CMS ask Congress to eliminate the ‘incident to’ billing provision, which is a vestige of a time when advanced practice registered nursing and physician assisting were nascent professions, and when state laws governing supervision of such practitioners were more restrictive,” the FTC concludes. “Instead, non-physician practitioners should be required to bill Medicare directly. Doing so could improve provider efficiency and beneficiary access to care and potentially reduce Medicare spending and beneficiary financial liability.”

Providers are eagerly awaiting how the post-pandemic regulatory and policy landscape shakes out. Which emergency measures will expire? What actions will state and federal regulators take to make sure that telehealth continues to advance and expand? Will CMS continue to support remote patient monitoring programs by allowing the patient’s home to serve as a telehealth site? Will privacy and security guidelines like HIPAA be revised to allow providers and patients to connect on more platforms, including the audio-only phone? Will reliable broadband become a reality? These questions and others can be the paradigm shift to new care delivery models.

Lisa Remington is widely recognized as one of the foremost futurists in the home care industry, focusing on healthcare trends and disruptive innovation. She serves as the president and publisher of the Remington Report magazine and is also the President of Remington’s Think Tank Strategy Institute. Lisa provides strategic advice and education to over 10,000 organizations, assisting them in developing transformative strategies for growth and their future implications. She closely monitors complex trends and forces of change to develop effective strategic approaches.

If you would like to access all the content in the current and past five issues of The Remington Report, but do not have a subscription, you may purchase one below.

Best Offer: 2-Year Premium

$144.97/Every 2 Years

- 12 bimonthly digital issues (accessible in PDF, Nook, Kindle, Apple Library, or digital formats) to The Remington Report

- Full access to the remingtonreport.com

- Access to back issues of The Remington Report

- Download access to the articles archives

- MarketScan reports

- Latest news from across the continuum

- Exclusive subscriber-only articles

- FutureFocus e-newsletter

- Case studies library

1-Year Classic

$74.97/Every 1 Year

- 6 bimonthly digital issues (accessible in PDF, Nook, Kindle, Apple Library, or digital formats) to The Remington Report

- Full access to remingtonreport.com.

- Access to back issues of The Remington Report

- Download access to the articles archives

- MarketScan reports

- Latest news from across the continuum

- Exclusive subscriber-only articles

- FutureFocus e-newsletter

- Case studies library