Why Do ACOs Limit Home-Based Care?

A recent study in the Journal of Managed Care was an eye-opener when it comes to better understanding home-based care from an ACO perspective.

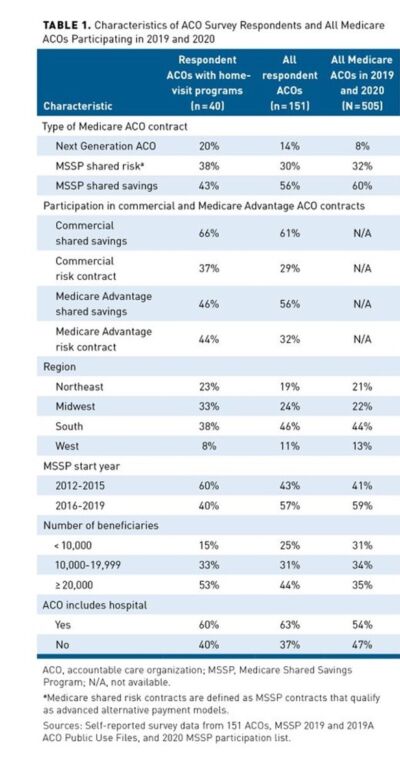

The study surveyed 151 participating in the Medicare Shared Savings Program (MSSP) or Next Generation ACO (NGACO) model as of July 1, 2019. Forty-four percent of respondents were enrolled in a Medicare ACO track with downside risk compared with 40% of all Medicare ACOs. Table 1. Twenty-five percent of ACOs had formal home-based programs, 25% offered occasional home visits, and 17% were actively developing new programs. The most common program was home-based primary care. Two-thirds has fewer than 500 visits.

Areas of Concern for ACOs

The concerns of many ACOs were focused on reimbursement. While ACOs deliver a diverse array of home-visit services including primary care, acute medical care, palliative care, care transitions, and interventions to address social determinants of health, many services provided are not billable, and therefore ACO leaders are hesitant to fund expansions without convincing evidence of ROI.

Funding sources included direct billing for services, health system subsidies, and ACO shared savings. “A majority of respondents expressed interest in expanding services but were concerned about their ability to demonstrate a return on investment (ROI), which was reported as a major or moderate challenge by three-quarters of respondents,” the study said.

Three key points were made in the study.

- With Medicare’s expansion of mandatory downside risk, more ACOs are considering home-based programs.

- ACO managers are hesitant to expand these programs unless they can demonstrate a return on investment.

- Expanding home-visit waivers to all risk-bearing Medicare ACOs and covering telehealth for patients receiving home-based primary care would improve these programs’ financial viability.

Looking Forward: Questions for Organizations

CMS’s commitment to value-based care has never been stronger. It announced a goal last year to move all Medicare beneficiaries into shared savings programs. Today, nearly one in five Medicare enrollees will be treated by ACOs Shared Savings programs.

More ACOs are also taking on risk this year, with 59% in two-sided risk tracks compared to 41% in 2021. An ACO agrees to meet certain spending and quality targets. The ACO gets a share of any savings it produces for meeting the targets but must repay Medicare for falling short.

This is an important time for your organization to prepare to partner based on risk. Questions to discuss.

- Does your organization understand the infrastructure of different types of ACOs? For example, in a Next Generation ACO quality of care is measured on 23 measures in four key domains, including patient/caregiver experience, care coordination/patient safety, preventive health and at-risk populations.

- How is/can your organization be partnering on ROI?

- What is your readiness for risk?

Lisa Remington is widely recognized as one of the foremost futurists in the home care industry, focusing on healthcare trends and disruptive innovation. She serves as the president and publisher of the Remington Report magazine and is also the President of Remington’s Think Tank Strategy Institute. Lisa provides strategic advice and education to over 10,000 organizations, assisting them in developing transformative strategies for growth and their future implications. She closely monitors complex trends and forces of change to develop effective strategic approaches.

Other Articles You Might Enjoy

Best Practices for Effective Strategy Execution

Effective strategy execution is crucial for success, as even the most well-crafted strategies can fail if not properly implemented.

5 Reasons Why a 5-Year Strategic Plan May Pose Challenges

Five-year strategic plans in home care often encounter several challenges due to the dynamic nature of the industry.

Understanding Adaptive Leadership in Home Care’s Complex World

Adaptive leadership is not a fixed set of rules or practices; rather, it's a mindset and a skill set that empowers leaders to thrive in turbulent times.