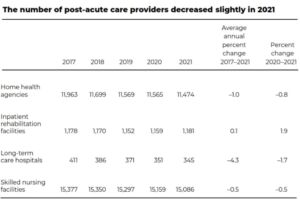

According to the most recent MedPAC (the Medicare Payment Advisory Commission) report, the number of home health agencies has been declining since 2013 after several years of substantial growth. The decline in agencies was concentrated in Texas and Florida, two states that saw considerable growth after the implementation of the home health prospective payment system in October 2000.

More about Post-Acute

- After declining for several years, the total number of inpatient rehabilitation facilities (IRFs) increased from 1,152 IRFs in 2019 to 1,159 IRFs in 2020. In 2021, the number of IRFs increased again to 1,181 IRFs. Most IRFs are distinct units in acute care hospitals; about one-quarter are freestanding facilities. However, because freestanding IRFs tend to have more beds, they account for about half of Medicare discharges from IRFs.

- After peaking in 2012, the number of long-term care hospitals (LTCHs) has decreased. The decline became more rapid after the implementation of a dual payment-rate system that reduced payments for certain Medicare discharges from LTCHs beginning in fiscal year 2016.

- The total number of skilled nursing facilities rose between 2016 and 2017, then decreased less than 1 percent per year between 2017 and 2021.

Source: MedPAC analysis of active provider counts from CMS Survey and Certification’s Quality, Certification, and Oversight reports (skilled nursing facilities and home health agencies) and CMS Provider of Services files (inpatient rehabilitation facilities and long-term care hospitals).

Home Health Agencies (HHAs) Received Tough News About 2023 Proposed Payment Updates

Proposals and Updates to the HH PPS for CY 2023

This rule proposes routine, statutorily required updates to the home health payment rates for CY 2023. CMS estimates that Medicare payments to HHAs in CY 2023 would decrease in the aggregate by -4.2%, or -$810 million compared to CY 2022, based on the proposed policies. This decrease reflects the effects of the proposed 2.9% home health payment update percentage ($560 million increase), an estimated 6.9% decrease that reflects the effects of the proposed prospective, permanent behavioral assumption adjustment of -7.69% ($1.33 billion decrease), and an estimated 0.2% decrease that reflects the effects of a proposed update to the fixed-dollar loss ratio (FDL) used in determining outlier payments ($40 million decrease).

Other Articles You Might Enjoy

Best Practices for Effective Strategy Execution

Effective strategy execution is crucial for success, as even the most well-crafted strategies can fail if not properly implemented.

5 Reasons Why a 5-Year Strategic Plan May Pose Challenges

Five-year strategic plans in home care often encounter several challenges due to the dynamic nature of the industry.

Understanding Adaptive Leadership in Home Care’s Complex World

Adaptive leadership is not a fixed set of rules or practices; rather, it's a mindset and a skill set that empowers leaders to thrive in turbulent times.