INTERACTIVE FEATURES: When viewing this article on an electronic device, note that web addresses are live links. Just click the link to visit that web page.

Click for instructions for moving the PDF into Kindle, Nook, Apple iBooks, and Apple Library.

Don’t Miss Additional Easy-to-Access Links In This Article and Other Resources to Learn More

Actions to Differentiate Your Organization from Competition

Compiled by the Remington Report Research Team

The Remington Report interviews Nick Knowlton to discuss how to manage referrals, grow referrals, exchange communications with referrals, and gain a competitive advantage. Knowlton is Vice President for Strategic Initiatives at ResMed and the Board Chairman for CommonWell Health Alliance.

Managing & Identifying Referrals

Remington Report: Referrals are the bloodline of every organization. How can home health, hospice, palliative care, and private duty organizations establish and promote greater consistency to manage referrals and where referrals are coming from?

Knowlton: We believe that good data drives good decision making. In 2019 we partnered with Porter Research to ask referral sources what they think of post-acute care providers and interoperability. We followed up with a successor to that survey in 2020.

What we found is this – interoperability is a key differentiator for home-based care agencies looking to build and maintain relationships with referral sources, new care networks and even payors. In the new survey out this month, 74% of referring providers said they are likely to change post-acute partners to those they believe can more effectively process electronic referrals. This is up from 60% in 2019, showing referral sources are becoming even more demanding when it comes to interoperability.

Referral sources’ most-mentioned areas of frustration with their post-acute care providers include poor response times, communication breakdowns and issues receiving information/confirmation. Post-acute care providers who are able to match their referral sources’ interoperability capabilities can eliminate all three – and that is an incredibly valuable advantage to taking cost out of the system, driving consistency in the process, and improving relationships with referral sources.

Mitigating Lost Referrals

Remington Report: In MatrixCare’s recent survey titled, “The Great Divide: Research Reveals Continued Interoperability Gaps in Post-Acute Care,” there is an alarming key finding: 74% of referring physicians are more apt to change post-acute provider partners to those they believe can more effectively process electronic referrals. What action can home health, palliative care, hospice, and private duty organizations take to mitigate losing physician referrals?

Knowlton: First and foremost, homebased care organizations need to recognize interoperability is real, delivering value to both post-acute care providers and their referral partners today, and that this is a trend that will only continue to accelerate. While 95% of post-acute care organizations surveyed view interoperability as being important to their referral sources, 85% of referral sources reported some level of dissatisfaction with their post-acute care providers ability to accept electronic referrals and 48% of post-acute care providers express dissatisfaction with their EHR’s capabilities to meet their interoperability needs. This represents the functional gap that provider organizations must close.

To get started on this journey, you should first understand the technology and modules that can impact the delivery of post-acute care and bring value to you and your partners. This starts with having conversations – both with your referral partners to understand how acute and ambulatory groups are practicing interoperability in a patient-centric manner and with your technology vendor to understand how you, as a post-acute organization, can tap into that. It’s important to make sure your current technology vendor has standards, technology, and policies that can match suit with referral sources so you can take advantage of the high-performing capabilities that exist among their referral sources. If not, it may be time to explore alternative solutions that can scale as you need them to.

Bi-Directional Data & Communication Exchange

Remington Report: Interoperability in simple terms is the bi-directional exchange of data, shared patient information, and 24/7 communications amongst providers. Referral sources look for relationships with other organizations that are easy to work with and that can deliver proven quality care. Describe the interoperability gaps existing today and how to solve that challenge.

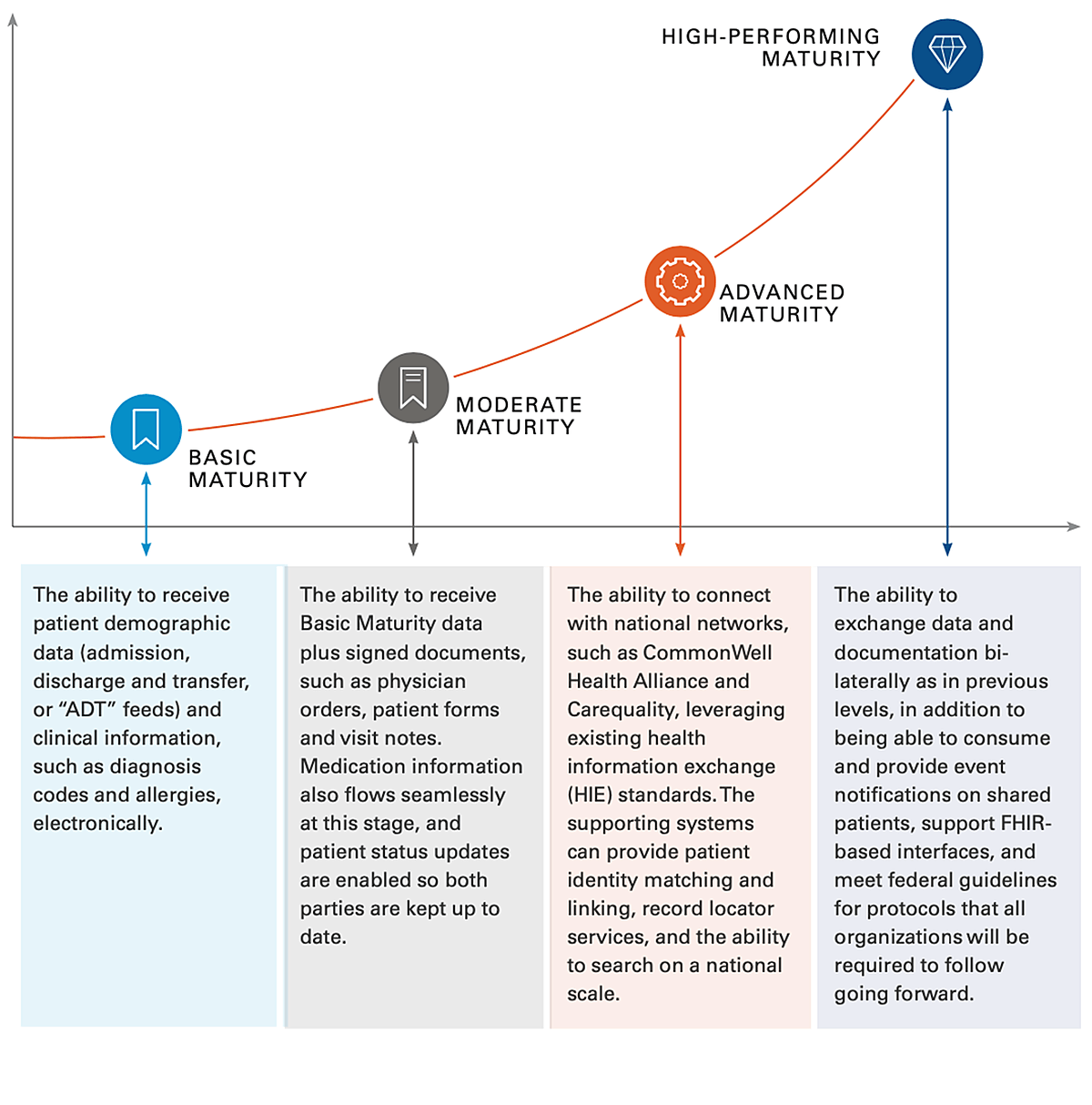

Knowlton: We saw in the report that while the interoperability gap is closing, there’s still a lot of work to be done. 85% of home-based care organizations said they can accept some sort of clinical or demographic information from referral sources, which we categorize as basic maturity. There are some nuances to that statistic, including whether that information comes in a machine-readable format or human readable only, which users then have to manually scan to find the patient information they need and manually enter into the EHR. This can lead to inconsistencies, errors and most certainly a poor user experience.

We believe true interoperability involves being able to pull discrete data out of the information you receive electronically and have that automatically populated in your EHR. As an industry, we need to start embracing higher levels of interoperability in quality care, like reconciling medications.

A common frustration amongst referral sources is also the inability to see care progression in post-acute settings. Provider organizations need mechanisms to provide active and even passive methods to update referral sources on how the patients in their care are doing. As post-acute care organizations need to often deal with dozens or more referral sources and other care providers as their patients continue their care journeys, speed to connect is a big consideration, as is cost. We believe interoperability goes far beyond specifications – you need networks and network effects to connect quickly and at a low cost. Providers need to understand the power of networks and frameworks such as DirectTrust, CommonWell Health Alliance and Carequality that can turn specifications into powerful tools for connecting care and proving value.

Competitive Strategy

Competitive Strategy

Remington Report: Growing referrals and expanding market share is a key strategy for building a sustainable future. What technology investments are important to grow and manage referrals?

Knowlton: To continue growing referrals and expanding market share, home-based care organizations need to evaluate where they fall on the interoperability maturity map and where they need to be based on the expectations of their referral sources. That evaluation will guide your technology investments.

More broadly, provider organizations should make sure their existing technology partner has the infrastructure in place to scale on their behalf. Look for EHR solutions that have scalable, high-performing architectures and interoperability that is built in and readily accessible to turn on and start using immediately.

Ask good questions of your vendor, such as – How will your technology approach scale to meet my needs? How fast can I participate at a high maturity level? How much will this cost? If your technology partner doesn’t provide suitable answers or capabilities, it may be time to explore alternative solutions.

My advice for every home-based care provider is to chart a course to get connected and move forward with interoperability today before today’s opportunity becomes tomorrow’s necessity. To read the full research report, connect here.

MatrixCare provides software solutions in out-of-hospital care settings. As the multiyear winner of the Best in KLAS award for Long-Term Care Software and Home Health and Hospice EMR, MatrixCare is trusted by thousands of facility-based and home-based care organizations to improve provider efficiencies and promote a better quality of life for the people they serve. As an industry leader in interoperability, MatrixCare helps providers connect and collaborate across the care continuum to optimize outcomes and successfully manage risk in out-of-hospital care delivery. MatrixCare is a wholly owned subsidiary of ResMed (NYSE: RMD, ASX: RMD). To learn more, visit matrixcare.com and follow @MatrixCare on Twitter.