- In 2020, there were 5,058 hospices.

- Medicare hospice expenditures totaled $22.4 billion.

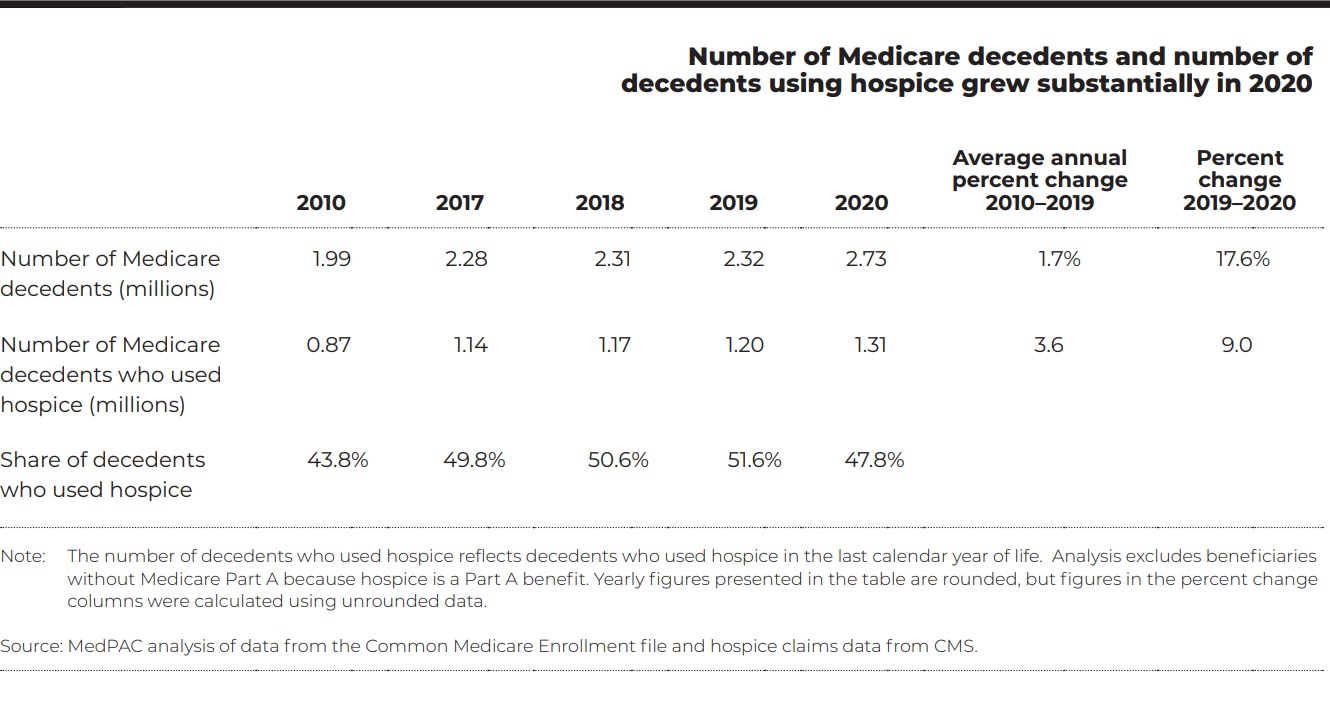

- In 2020, more than 1.7 million Medicare beneficiaries (including almost half of decedents) received hospice services.

- In 2020, the number of hospice providers increased by 4.5 percent, due to growth in the number of for-profit hospices, continuing a more than decade-long trend of substantial market entry by for-profit providers.

- Between 2019 and 2020, average lifetime length of stay among decedents grew from 92.5 days to 97.0 days, and the median length of stay was stable at 18 days.

- Volume of services: In 2020, the number of beneficiaries using hospice services at the end of life continued to grow. However, the share of Medicare decedents using hospice declined between 2019 and 2020, from 51.6 percent to 47.8 percent, as deaths increased more rapidly than hospice enrollments.

Number of Medicare decedents and number of decedents using hospice grew substantially in 2020

- Cost growth: Between 2018 and 2020, hospice cost growth was generally modest. Average cost per day for routine home care, the level of care that accounts for more than 98 percent of hospice days, increased 0.5 percent between 2018 and 2019 and 1.2 percent between 2019 and 2020. In contrast, average cost per day for general inpatient care, inpatient respite care, and continuous home care, which are provided relatively infrequently, rose substantially in 2020.

- Aggregate Cap: The cap limits the total payments a hospice provider can receive in a year in aggregate. The aggregate cap functions as a mechanism that reduces payments to hospices with long stays and high margins. In 2019, about 19 percent of hospices exceeded the cap; their Medicare aggregate margin was about 22 percent before and 10 percent after application of the cap.

Other Articles You Might Enjoy

6 Key Trends: Which Medicare Patients are Adopting Telehealth the Fastest?

Telehealth services are nearly two times higher than pre-pandemic levels, with more than one in 10 (12.7%) eligible beneficiaries receiving a telehealth service in the final quarter of 2023.

Chronic Conditions Most Seen in the ED

59.5% of adult ED visits are for patients with chronic conditions according to a study published in the National Health Statistics Reports.

9 Medical Conditions Related to Home Healthcare Expenditures

Nine specific medical conditions contributed the most to home health expenditures. One, in particular, accounted for the largest share of spending at 48.9%.